The Consilience Energy Advisory Group

Revenue Analysis, Apportionment and Hedging (RAAH)

The Consilience Energy Advisory Group has launched a new software tool that does the heavy lifting for oil producers, oil asset traders and analysts investigating the revenue stream in oil project economics.

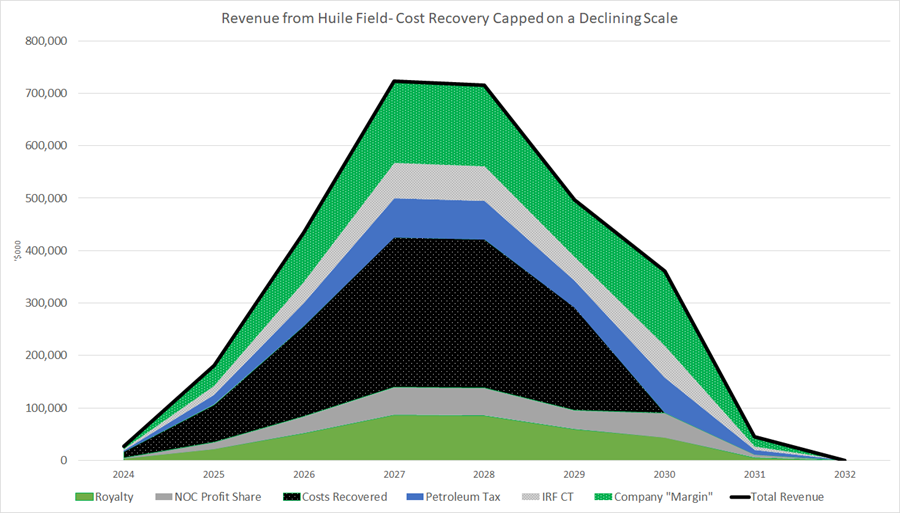

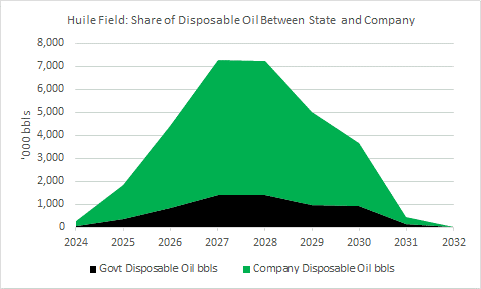

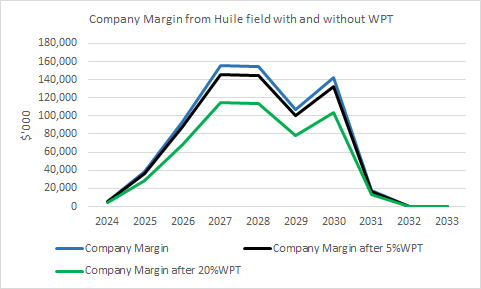

The Revenue Analysis, Apportionment and Hedging (RAAH) package is not based on any one specific country’s petroleum legislation but includes the components of the production sharing contracts that are encountered repeatedly around the world- royalty paid in cash or in kind, cost recovery, profit sharing with the government or NOC, petroleum tax and corporation/profit tax. RAAH allows the user to tailor the analysis to its own situation by inputting appropriate assumptions for each project and highlights the consequences if these assumptions turn out to be wrong.

Liz Bossley, the CEO of Consilience said: “Small E&P companies tend to focus on costs where they feel they have more control, than the revenue stream, where they often feel they are price takers at the mercy of the market. At best the E&P companies may be missing a trick; at worst, they can end up with inappropriate hedges that do not match their retained revenue stream once royalty, cost recovery, government profit share and tax are taken into account.

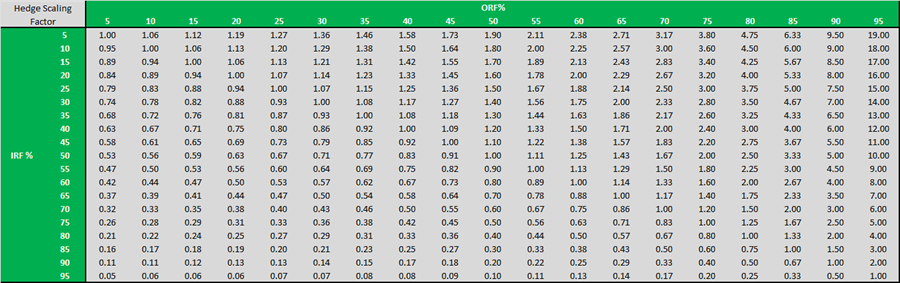

When financiers insist that the forecast revenue stream is hedged to underwrite debt repayments, the amount of hedging that is appropriate is often under-analysed.

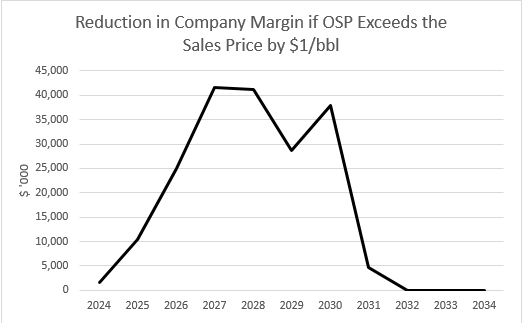

RAAH works out how the user’s input assumptions fit together to determine the right amount of hedging that has to be undertaken to protect its retained revenue stream and underwrite loan financing. It calculates the consequences if the state’s official selling price (OSP) diverges from the joint venture partners’ actual sales price. It determines the scaling factor that has to be applied to forecast production when there is unequal tax treatment of physical sales and hedge gains and losses, by adjusting the volume of hedging that has to be undertaken.”

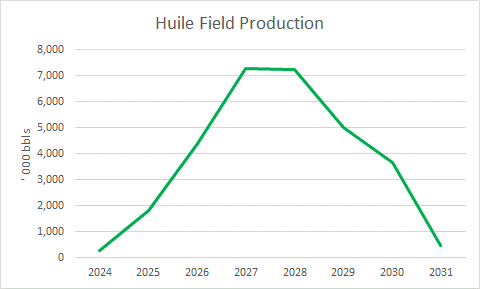

According to Consilience, RAAH generates almost 500 tables and over 250 charts instantaneously when the user inputs data for up to 20 fields over a 20-year period. It also allows users to import data from Microsoft Excel to permit rapid input of large blocks of data and to export the resulting outputs to Microsoft Excel to permit the user to incorporate RAAH results into other applications, such as the company’s economic model.

I have known CEAG and its team for many years and Liz Bossley is one of the most highly respected executives in the industry. I’m sure that if any reader of the blog has any interest in RAAH then she or one of the team will take it down into a lot more detail.