26 Jan They shoot horses dont they

The Brent benchmark is long overdue to be put out of its misery humanely. This tired old workhorse has been limping along with the increasingly onerous burden of being the key reference point for setting the price of, arguably, two thirds to three quarters of the world’s crude oil since 1981: that was when the first 15-day Brent contracts were traded. But, rather than put this beast of burden out to pasture, the oil industry is on the point of choosing to keep it in service with an injection of steroids- the inclusion of West Texas Intermediate (WTI) into the basket of grades of North Sea that form the Brent price currently.

As production has declined over the years, “Brent” has been rejuvenated on several occasions with the introduction of a basket of different grades – Forties, Oseberg, Ekofisk and Troll- that can be delivered into the Brent forward contract, 30-Day BFOET[1], and the Dated Brent price assessment, published by the Price Reporting Agency (PRA), S&P Global Platts.

BRENT, FORTIES, OSEBERG, EKOFISK AND TROLL – PREMIA AND DISCOUNTS FOR QUALITY

The disparate quality of these grades has led to the introduction of various quality adjustment factors and a de-escalator in an attempt to bring the value of these different grades into line with the price at which “pure” Brent Blend would be trading, if there was sufficient Brent Blend around to provide a database of actual trades, which there is not. These quality-related factors are:

- Quality Premia for Oseberg, Ekofisk and Troll cargoes for delivery in month, M, which are assessed by Platts at 60% of the net price differences between Oseberg, Ekofisk and Troll, also as assessed by Platts, and the lowest priced grade oil in the Brent basket published by Platts during month M-1;

- The Forties sulphur de-escalator adjusts for the fact that Forties has been higher in sulphur content than Brent since the introduction of the Buzzard field into Forties Blend in 2007, after Forties Blend had formed part of the Brent basket for about 5 years. This de-escalator takes the form of a price reduction by $X/bbl for each 1% weight of sulphur over the 0.6% wt is the Forties Blend cargo being traded. The value of X is assessed by Platts by reference to “sweet and light crudes versus sourer and heavier streams in the North Sea and other competing regions, as well as the performance of refined products and refinery feedstocks, and the outright price of crude oil” , says Platts. This X factor is set monthly by Platts. If physical cargoes do not apply this de-escalator they do not qualify for inclusion in the Platts database.

CIF TRADES – ADJUSTMENTS FOR FREIGHT, SAILING TIME AND PORT DUES

Then in November 2019, a Rubicon was crossed when trades in these same grades that are sold on a delivered CIF Rotterdam basis were included in the basket, specifically in the formation of the key Dated Brent assessment. Dated Brent refers to cargoes loaded on a rolling 10-30 days forward from each Platts publication date. The CIF prices are netted back to give an FOB equivalent price adjusting for freight, sailing time and port dues. Sailing time and port dues are relatively transparent, but the assessment of freight is a different matter. The amount of freight that is deducted from the CIF price is weighted “by a freight adjustment factor, to account for any differences in optionality between a

[1] Market short-hand has stopped adding new letters to the BFOE acronym, despite the inclusion of Troll. This is something of a relief as further grades are likely to be added to the basket and the possibility of unfortunate anagrams increases.

FOB and a CIF offer”, according to Platts. The cost of freight to which this factor is applied to the 10-day rolling freight average of the Dirty Cross-UK/Continent 80,000 mt freight assessment (you’ve guessed it) as assessed and published by Platts.

The concept of including CIF cargoes in an FOB basket has opened the door for including grades from other parts of the world delivered to Rotterdam. This brings us to the current proposal to include US West Texas Intermediate Midland (WTIM) into the Platts Dated Brent assessment.

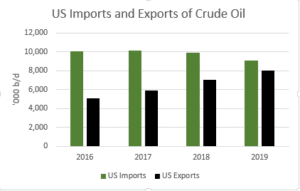

WTI used to be well understood as the domestic American grade that was delivered inland to Cushing, Oklahoma and which could be delivered into the CME (NYMEX) futures contract to settle contracts with physical delivery rather than by reference to a cash-settled book-out price. That all changed at the end of 2015 when the ban on US crude exports, which had been in place since 1975, was lifted.

Source: BP Statistical Review 2020

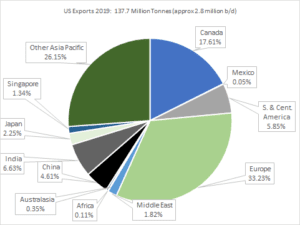

The US exported about 1 million b/d of crude oil to Europe in 2019, and it is this volume that is being considered to boost the database of transactions that may be able to shore up the Brent price benchmark.

Source: BP Statistical Review 2020

WTIM IN THE BRENT BASKET

Platts is now proposing that the Platts WTI Midland (WTIM) price quotations be included in the assessment of the Dated Brent benchmark from March 2022- a long lead time to allow traders to adjust their contractual arrangements to reflect the new Dated Brent price assessment.

Exploration and production companies, who employ the Dated Brent price assessment in longer term sales contracts, are unlikely to appreciate that this will have an impact on the value of the benchmark price on which their contracts are based. They are equally unlikely to avail themselves of any price re-opener clauses that will allow them to review any price differential between the price of their own specific grade of oil and the new-style Dated Brent.

Among the myriad of other questions that the inclusion of WTI in the Brent basket raises is why use the WTI Midland price quotation? Midland Texas is ~425+ miles from the Gulf Coast from whence exports actually take place. Any price based on Midland Texas is subject to a further variable, namely the cost of transporting the WTI from Midland to Houston. This too would have to be factored out to make WTI trades comparable with Brent FOB Sullom Voe.

WTIM describes crude originating in the Permian Basin, which goes straight down one of the direct pipelines for loading at Corpus or Houston without commingling. This avoids any risk of blending taking place to downgrade the quality, as is suspected of crude arriving from Cushing. Platts places limits on the quality of oil it will accept in its WTIM assessment, although it has no power to change the actual quality of the crude that is shipped.

An alternative WTI quotation that is liquid and closer to the coast, but not actually on the coast, is WTI at Magellan East Houston (WTI MEH). This grade trades at a premium to WTIM and is mainly supplied into US Gulf Coast refineries because of its convenient proximity. Exports of WTI MEH require transportation between US ports, an activity that remains subject to the Jones Act. This Act obliges all shipments between US ports to be conducted on US-flagged, US-built, and US-crewed vessels. This bumps up the costs above international freight rates. So, while WTIM delivered at place (DAP) Rotterdam is an active market, WTI MEH is not. WTIM looks likely to win out in any discussion of including WTI in the Brent basket.

The nature of the WTIM trades that Platts proposes to include in the Dated Brent assessment are not only WTI Midland DAP Rotterdam, but will include any WTIM oil trans-shipped and sold FOB Scapa Flow in the Orkneys Isles off the North Coast of Scotland. In reality, little, if any WTIM, has ever traded on an FOB Scapa Flow basis. Rather, it is proposed that deals done DAP Rotterdam are to be netted back to an FOB Scapa flow basis by Platts before inclusion in the Dated Brent price database. Hence, the cost of bringing WTIM to Scapa flow would not necessarily be a feature of the price assessment of WTIM in the Brent basket.

It may be argued that the origin of the WTI that arrives at Rotterdam is irrelevant, other than for establishing the quality of the WTI that is being proposed for inclusion in the Brent basket: what is called WTI varies in quality depending on the pipeline system used to gather it[1]. Precisely how any quality adjustment that will be needed to fit WTIM into Brent basket quality will be done is still up

[1] WTI Midland API 38-44o, sulphur <0.45%; WTI MEH API 42 o, sulphur 0.15%; WTI Cushing API 41 o, sulphur 0.4%, according to Platts.

for discussion in Platts’ consultation which ends on February 5th 2021. But it increases the significance of Ship-to-Ship (STS) transfers in Scapa flow in the Dated Brent price assessment process.

WTIM in Brent is another step along the path of including a range of grades from further afield into the Dated Brent assessment process.

IS THERE AN ALTERNATIVE?

The amount of deal evidence, or rather the lack of it, is the whole crux of the problem. The burden of Brent rests on deals, or more often, just bids and offers, posted in the Platts window by a restricted number of traders during a half hour period. A lot of this database is made up of part cargoes, not full cargoes. The responsibility for filling in any blanks has been relinquished by the oil industry to Platts.

This may suit the industry quite well. It relieves the oil companies and trading houses of a lot of the effort needed to have a say in the price that will show up in physical contracts all around the world. The existence of the Platts window concentrates the focus of price discovery for contractual purposes into a short half hour period and a small volume of trade each day.

Theoretically, the industry could get together and convene an independent panel to take the methodology for establishing benchmark pricing back into the hands of those that are active in the market. But the spectre of anti-trust regulations provides a convincing get-out clause for pursuing any such idea.

Ultimately, the oil trading community has got the oil price formation process for which it has been prepared to settle and which, perhaps, it deserves.